Our Trading

Internship

From theory to practice and back again

Jane Street’s trading internship is designed to cultivate advanced decision-making and problem-solving skills as applied to modern financial markets. You’ll learn from brilliant people, bringing concepts from classroom lectures directly to project work and trading simulations. Rapidly iterating between learning and practice will allow you to learn faster and more deeply than you thought possible.

No fluff, paced to challenge

Our curriculum assumes no prior knowledge of finance, trading, or markets, but takes off in a hurry. Even introductory classes rapidly move beyond basic trading concepts to reveal the complex nuances that drive opportunity in the real world. As you progress, your mentors will continue to challenge you to do more – including researching ideas we are hoping to put into production on the trading desk right away.

A typical day

8:45

Grab breakfast from the many options in our café.

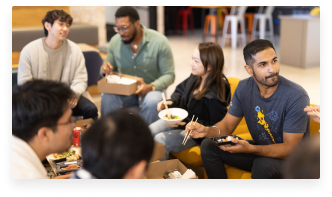

9:00

Independent project work: Catch up with your mentor, an experienced full-time trader, and receive guidance on next steps for your project.

11:30

Class: Learn about a wide variety of topics, such as the complexities of different financial products, interesting trades from the past, GPU programming, Information Theory…or even Poker!

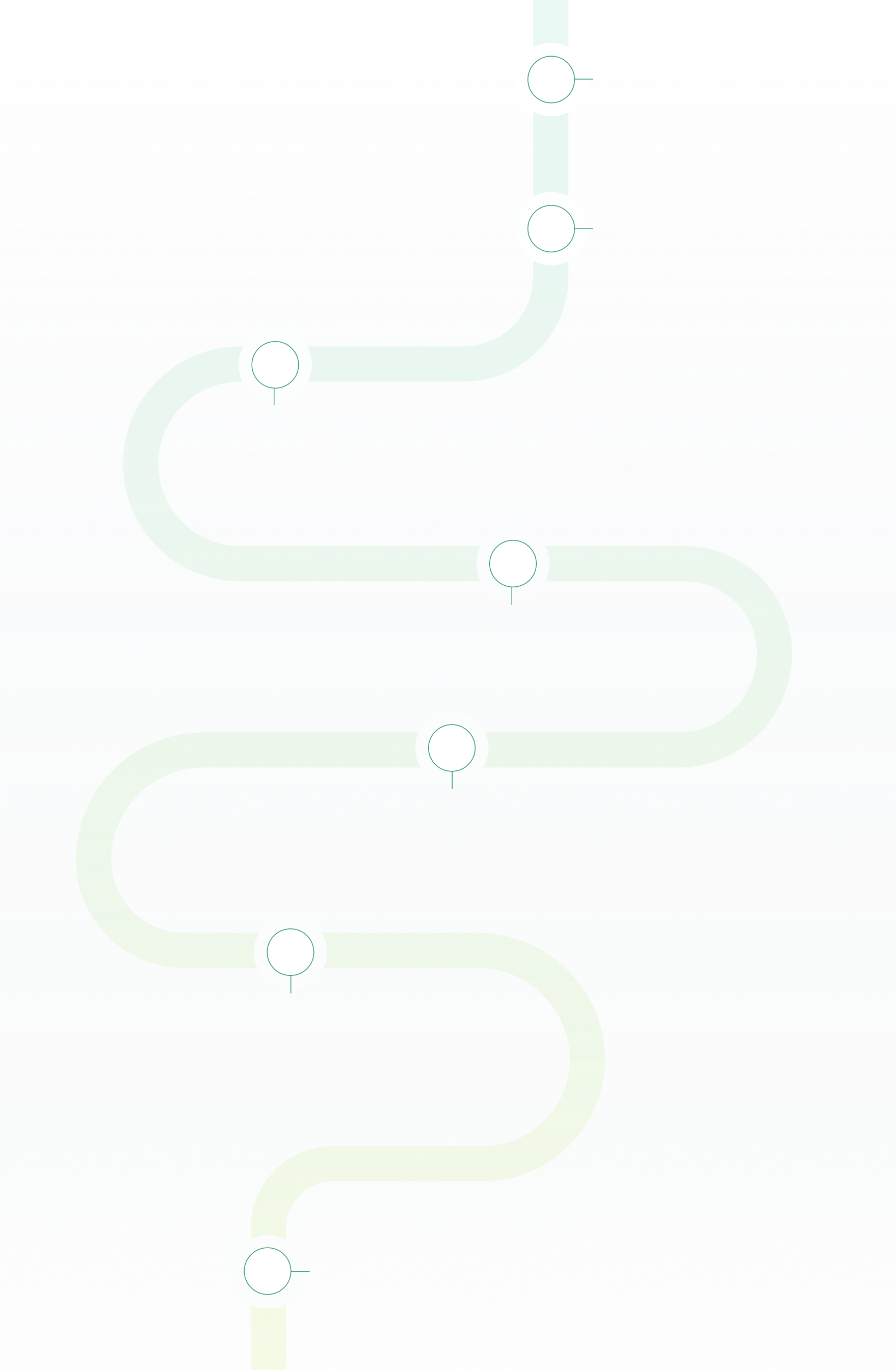

12:30

Lunch: Meet up with some fellow interns and a few full-timers for lunch, to discuss interesting recent market events and updates on your projects.

2:00

Elective Workshops: Join a workshop related to your elective, such as coding up an algorithmic trading strategy, or using machine learning techniques on a custom-built dataset.

4:00

Mock trading: Team up with fellow interns to analyze, and trade on, a trading scenario constructed by full-time traders.

6:00

Social Events: Unwind after a busy day! Attend a sports game, grab dinner with your team, or explore the city with other interns!

Paths to Explore

At Jane Street, a trader might focus on anything from real-time decision-making to designing trading algorithms to training deep learning models. The internship’s elective program allows you to intensively explore the part of the landscape that most excites you.

The Strategy Elective

In the Strategy elective, you'll work with fellow interns and full-time traders to analyze complex trading scenarios, and then trade on them in a simulated environment. You'll learn how traders at Jane Street drive the firm's strategic and risk decisions in response to market events and order flows.

The Algo Elective

In the Algo elective, you'll work closely with Jane Street traders to analyze market data and implement an automated trading system. You'll adapt your strategy to various market structures and work to optimize its performance, gaining hands-on experience in developing effective and performant trading systems.

The Modeling Elective

In the Modeling elective, you’ll learn about a variety of statistical and machine learning techniques, and have a hand at applying these techniques to real world data in team-based challenges. Advanced proprietary trading models are the backbone of Jane Street’s operation, and you'll delve into everything from the nuts-and-bolts of building a good data pipeline to the conceptual thinking behind different types of deep learning techniques.

Mentorship that Matters

During the internship I found it really fun to learn by being able to make mistakes and ask lots of questions. My mentor's feedback was really helpful and challenged me in a new way!"

- Feina

I really appreciate all the help I got from everyone at Jane Street over the whole summer, and I wouldn't have made it anywhere close to this far from where I was at the start of this summer without the support of so many people throughout the internship.”

- Aaron

Thank you for teaching me more than I thought it was possible to learn in a summer, both about trading and about what makes a workplace a good fit for me.”

- Charlotte

My internship was genuinely the most fun and educational experience of my life, and I thoroughly enjoyed every minute of it.”

- Harry

The internship was a great mix of challenging, rewarding, and fun; I learned more than I thought I could in 11 weeks.”

- David

A Culture of Collaboration

We thrive on openness and collaboration. Our open-plan office isn't just a design choice—it's a reflection of our culture. Imagine a space where ideas flow freely across trading desks, where impromptu discussions spark innovation, and where every day brings new intellectual challenges. If you have an inquisitive mind and a collaborative spirit, we have a feeling you’ll fit right in.