Exploring new frontiers in machine learning

A lot of the problems that I work on feel like very new ground, and I’d be surprised if we weren’t some of the first people in history to be solving these problems.

- Declan, ML Researcher

Hear more from our ML team.

Think of Jane Street as a research lab with a trading desk attached to it

We believe deep learning is the future of quantitative trading. To get us there, our machine learning team creates the neural network models driving our trading strategies, and builds the infrastructure that make training and inference possible.

What’s unique about machine learning at Jane Street?

We break new ground in predictive modeling, developing approaches that have never been tried before. Here’s some of what we’re up against:

- Financial markets produce a torrent of data, mostly noise.

- We need ultra-low latency systems just to process it.

- Market data is “regime-y,” in that it undergoes frequent structural changes in reaction to things like pandemics, elections, new regulations—even swings in the collective mood.

- Identifying these distinct distributions can be tricky, let alone learning against them.

- And just when we think we’ve got it, our own actions influence the data we’re trying to model (itself a very fun problem to think about).

Thousands

of high-end GPUs

$190

billion

daily filled dollars

323 petabytes

current storage

What does machine learning look like at Jane Street?

- No silos. Researchers, engineers, and traders sit a few feet away from each other and work together to train models, build systems, and run trading strategies.

- Depending on the day, we might dive deep into market data, tune hyperparameters, debug distributed training, or study our model’s trades in production.

- We build on the latest papers in LLMs, computer vision, RL, training libraries, cuda kernels, or whatever else we need to train good models.

- We invent our own set of architectures, tricks, and optimizations that work for trading.

Opportunities

Help us pioneer the future of finance.

Featured Open Roles

ML Researchers invent and reinvent the methods and models driving our trading strategies.

ML Engineers bring our models to life with the best tools for the job.

ML Performance Engineers speed up our models, automate them, and manage the care and feeding of our training loops.

Resources

Podcast

Go behind the scenes with our ML team

Hear conversations on ML, markets, model acceleration, and more.

Blog Post

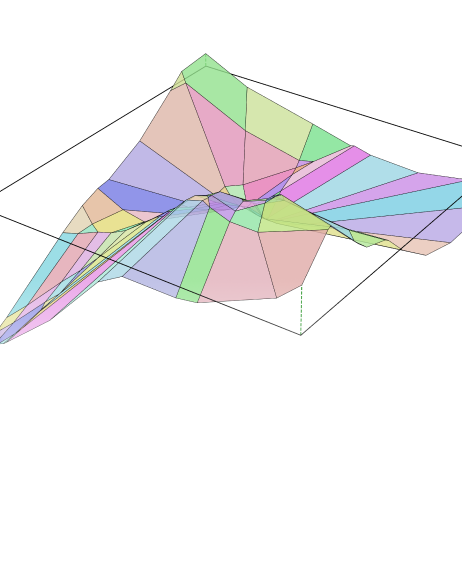

A New Way to Visualize Piecewise-Linearity

One Streeter animated the output of a neural net. It may look familiar.

Video

Meet Matt at Jane Street

He’s helped us grow our ML team since 2012.

Video

Meet JP at Jane Street

Modeling his average day would be a challenge.